BookTrib’s Bites: Fact, Fiction and a Little in Between

(NewsUSA) -

-  Every Other Weekend by Anthony Mohr

Every Other Weekend by Anthony Mohr

Shuttling between two fathers and coming of age at a time when divorce is rare and viewed as shocking, the author writes of living at the edges of what others regard as a dream world, a place where reality and fantasy blend, maps lead to the homes of the stars, and obstacles abound.

Anthony's father is a well-known radio actor before slipping to the Hollywood B-list thanks to the advent of television. Accepting the lead in a dying Swedish TV series, he falls for the script girl and divorces Mohr's mother, who marries another divorcee, a credit card industry pioneer.

As his stepfather's career rises and his biological father's eases downward, Anthony tries to find his place: one weekend sailing on a 58-foot catamaran, the next being told he is poor. Purchase at https://bit.ly/3Z50vM5.

The Sundial Inn by Stephen John Ross

The Sundial Inn by Stephen John Ross

A paranormal horror with a streak of dark humor. On a return flight from a dream vacation at the Sundial Inn in the outskirts of New Orleans, Tim and Sara find themselves covered in bruises with no memory of the past three days. The mystery deepens once they learn the inn had ceased operations many decades earlier in 1954.

Plagued with lucid nightmares, Sara struggles to return to her normal life while Tim returns to New Orleans in search of answers. Aided by a local clairvoyant Mrs. Lizzie, the secrets of the Sundial Inn and its founder, Atticus Busby, are unearthed. There’s more to the inn than meets the eye, and Tim begins to realize that his own connection to it is much darker than he could have guessed. Purchase at https://bit.ly/3Gwv5FP.

Royal Coconut Beach Lunch Club by Diane Bergner

Royal Coconut Beach Lunch Club by Diane Bergner

Julia Wild is thrilled to trade her legal briefcase for stiletto heels and a glam wardrobe when she accepts the position as high-society fundraiser at a prestigious performing arts center. But the gala lifestyle is a minefield. There’s the punishing schedule, her boss is having an affair with an important donor, and someone is trying to sabotage her. But she weakens to the seduction of elite social circles.

The deeper Julia is drawn in, the more fantasy and reality blur, and fault lines in her marriage surface – especially when she meets a debonair Argentinian billionaire. It is only when suspicion caused by an untimely death blows up the carefully constructed glittering mask of the moneyed set that Julia must decide how willing she is to risk everything. Purchase at https://bit.ly/3Ka54Qg.

Starstruck by Michael Kutza

Starstruck by Michael Kutza

“Starstruck: How I Magically Transformed Chicago into Hollywood for More Than Fifty Years” is the author’s rollicking, provocative, racy, colorful, irreverent show business memoir culled from decades of rubbing elbows with the giants of film at both the Chicago Film Festival, which he founded, and numerous other festivals around the globe.

It was a roller-coaster ride that lasted for almost half a century, with Kutza presiding over gatherings that hosted a Who’s Who of the film world – from Harold Lloyd to Clint Eastwood, Bette Davis to Viola Davis, Steven Spielberg to Spike Lee, Guillermo del Toro to Jodie Foster, Lauren Bacall to Al Pacino. At the same time, the festival introduced a plethora of new talent that would go on to revolutionize the movie business, from Martin Scorsese on. Purchase at https://bit.ly/40E0lMe.

BookTrib’s Bites is presented by BookTrib.com.

-

-

- A new poll paints a troubling picture of how anxious Americans are about their finances.

- A new poll paints a troubling picture of how anxious Americans are about their finances. -

-

- From election-season opinion polls to holiday-season parties, “fake news” is everywhere – and the harm goes beyond what’s said on the evening broadcast or the dinner table.

- From election-season opinion polls to holiday-season parties, “fake news” is everywhere – and the harm goes beyond what’s said on the evening broadcast or the dinner table. -

-  Murder Baby by G.J. Stoutimore

Murder Baby by G.J. Stoutimore My Name’s Not Jenny by Jeannine Lokey

My Name’s Not Jenny by Jeannine Lokey Lemon Curd Killer by Laura Childs

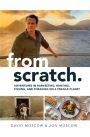

Lemon Curd Killer by Laura Childs From Scratch by David Moscow & Jon Moscow

From Scratch by David Moscow & Jon Moscow